How can I avoid Collection Calls

How can I avoid Collection Calls

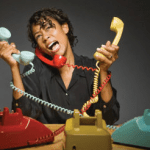

Many Canadians are very uncomfortable receiving a collection call from a bill collector. In some instances it can be a major headache for an Ontario resident to get a collection call at the workplace. There are three basic strategies for avoiding collection calls:

- Reduce the likelihood that a bill collector can find your phone number

You might want to get a new phone number if you are getting phone calls or you anticipate receiving collection calls. If you have a landline you should consider getting an unlisted number—and advising friends and family not to give out this unlisted number to anyone. Furthermore, you should avoid having your name mentioned on your voicemail greeting.

- Effectively screening potential phone calls from bill collectors

There are a substantial number of tactics you might employ to screen your calls:

- Letting all incoming calls go to voicemail

- Using the call display feature on your phone to screen your calls

- Have someone else answer your phone

- Decline to give out your name to callers unless they first identify the name of their employer

- Dealing with a bill collector who does get you on the phone

If a bill collector does get you on the phone then you have every right to hang up on the bill collector—or simply put the phone down on the table, or let them talk to your dog—at any time! You are under no legal obligation whatsoever to speak to a bill collector.

Contact Rumanek & Company Ltd. for more information on bankruptcy and debt solutions. Or please fill out the free bankruptcy evaluation form. To learn more please visit our YouTube Channel. Rumanek & Company have been helping individuals and families overcome debt for more than 25 years.

How can I avoid Collection Calls

How can I avoid Collection Calls If I Declare Bankruptcy can I be a Director?

If I Declare Bankruptcy can I be a Director? Bankruptcy and Student Loans in Canada.

Bankruptcy and Student Loans in Canada.

Bankruptcy Terms & Definitions:

Bankruptcy Terms & Definitions: